IPO Marketing & Distribution

Second Annual FinFair Conference

The date and venue for FinFair, Wall Street’s only conference dedicated to the leadership, products and technologies that are democratizing the alternative asset landscape, will be announced shortly.

This year’s program will focus primarily on the significance of tax-deferred micro alternative investing, the rebirth of the retail investor, emerging FinTech opportunities, a changing regulatory climate as well as innovative distribution channels for online platforms and conventional financial services providers.

Participants will include: retail investors, financial advisors, online finance platforms, roboadvisors, FinTech visionaries, venture capitalists, investment bankers, regulators, legislators, financial services providers, analysts, retirement specialists, economists and credentialed members of the media.

Please fill out the form below if you’d like to participate or simply stay informed. We look forward to seeing you soon and to instilling a new culture of FINancial FAIRness!

FinFair speaker and BANQ founder preaches caution

Mark Elenowitz, the CEO and Founder of BANQ, understands the excitement surrounding aspects of the JOBS Act, but cautions those pondering a mini-IPO need to consider all of the impacts or they risk damaging their prospects over the long term. In an interview with Bankless Times, Elenowitz discusses SPOs (Sponsored Direct Offerings), FINRA Rule 0905 and Reg A+ liquidity.

Mark Elenowitz, the CEO and Founder of BANQ, understands the excitement surrounding aspects of the JOBS Act, but cautions those pondering a mini-IPO need to consider all of the impacts or they risk damaging their prospects over the long term. In an interview with Bankless Times, Elenowitz discusses SPOs (Sponsored Direct Offerings), FINRA Rule 0905 and Reg A+ liquidity.

The FinFair Conference Announces the Live Global Broadcast of Its Groundbreaking FinTech and Financial Alternatives Program

The FinFair Conference Announces the Live Global Broadcast of Its Groundbreaking FinTech and Financial Alternatives Program

NEW YORK, NY–(Marketwired – July 15, 2015) – FinFair 2015, the first conference to feature the leadership, products and technologies driving the crowd-centric retail alternatives market, is pleased to announce that it will be providing a live broadcast of Wall Street’s inaugural conference focused on the financial innovation emanating out of first-generation marketplace lending and equity crowdfunding platforms, and made possible by the implementation of Reg A+, a key component of the JOBS Act.

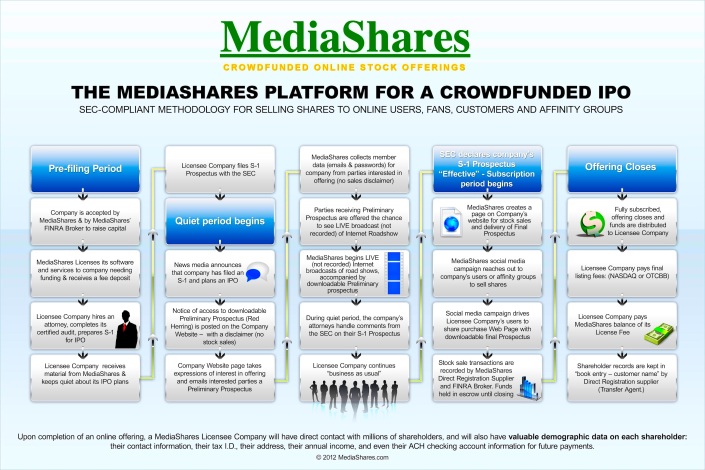

The film production is being handled by the video deal marketing arm of MediaShares, a company possessing a patented technology to facilitate crowdfinanced IPOs and known for broadcasting some of the biggest conferences in the industry including P2P and online eminent, LendIt.

The live broadcast will begin promptly at 8:30am EDT on July 29th and will continue to 6pm EDT. The footage will cover topics from the show including:

- Applications of Reg A+ from small business capital formation to private debt securitizations

- Enhancing small cap deal distribution & aftermarket support

- How Reg A+ will Transform Community Investing

- An introduction to next-Gen Broker Dealers and online financing platforms

- How Financial Advisors and RIAs will benefit from Reg A+

- Building vibrant venture exchanges

- New trends in liquidity and clearing

- Diversifying fixed-income portfolios with P2P, P2B and P2R debt

- Distinguishing between a FinTech bubble or a financial revolution

A comprehensive agenda can be found at http://finfairconf.com.

To register for the live broadcast, please visit http://finfairlivebroadcast.eventbrite.com.

For those interested in the unparalleled networking opportunities, feel free to join us in person at the IBM Innovation Center in New York City. Onsite participants will include: financial advisors, RIAs, fund managers, family offices, angel investors, investment bankers, analysts, exchanges, issuers, and select members of the financial media. General admission tickets are available at http://finfairconf.com.

Press passes for credentialed members of the press can be obtained by emailinginfo@finfairconf.com.

“There is an incredible amount of financial ingenuity transpiring in the crowd-based retail alternatives space. A plethora of new funds are emerging that possess sophisticated technologies and algorithms to help retail investors maximize P2P returns. For the first time, tools are being developed to help financial advisors and RIAs manage their clients’ P2P portfolios. Concomitantly, innovative custody solutions are being implemented to enable financial advisors and RIAs to maintain a host of alternative assets under management. Apps are being created to help the masses invest in their peers and more realistically prepare for retirement. New technologies are currently being employed to transform the way offering memorandums are structured, and the way in which securities are marketed to retail investors. All of these innovations will have enormous implications on the future of financial services and it’s my true honor to have the opportunity to introduce all of them to financial professionals and investors across the globe,” stated Dara Albright, co-founder of FinFair.

ABOUT FINFAIR:

FinFair is the first conference platform to feature the leadership, products and technologies driving the crowd-centric retail alternatives market. Being held at the state-of-the-art IBM Innovation Center in midtown Manhattan on July 29th, FinFair 2015 will feature a world-class educational program led by some of the most prominent figures in finance, fintech, and securities governance; live demos and unparalleled networking opportunities. Attendees will include financial planners and advisors, wealth managers, RIAs, family offices, venture investors, investment bankers, analysts, CEOs/CFOs and financial innovators. FinFair is the brainchild of Dara Albright, most known for her acclaimed conferences that have consistently broken new ground in the Wall Street convention space with the introduction of new financing structures and emerging asset classes such as crowdfunding, P2P & online lending. Additional information can be found at http://www.finfairconf.com.

CONTACT INFORMATION

-

FinFair Media Relations

(678) 802-4068

info@finfairconf.com

FinFair speaker Steve Dresner talks about turning data into intelligence

According to Steve Dresner, “The biggest story is not providing access to data, but in turning that data into intelligence.” Click here to read more about how Dealflow is using algorithmic matchmaking to help underwriters enhance deal distribution and broaden their reach.

FinFair’s Massey will show you how to leverage existing audience in capital raise

Must-read Bankless Times Interview with Gene Massey, CEO of MediaShares